- Briefcase — Product updates

- Posts

- 💼 Product Update — 21/7/2025

💼 Product Update — 21/7/2025

CIS transactions

Welcome to our weekly product update. Each week, we highlight Briefcase’s latest features and AI improvements designed to make bookkeeping and accounting workflows simpler and more efficient. Here’s what’s new.

CIS transactions

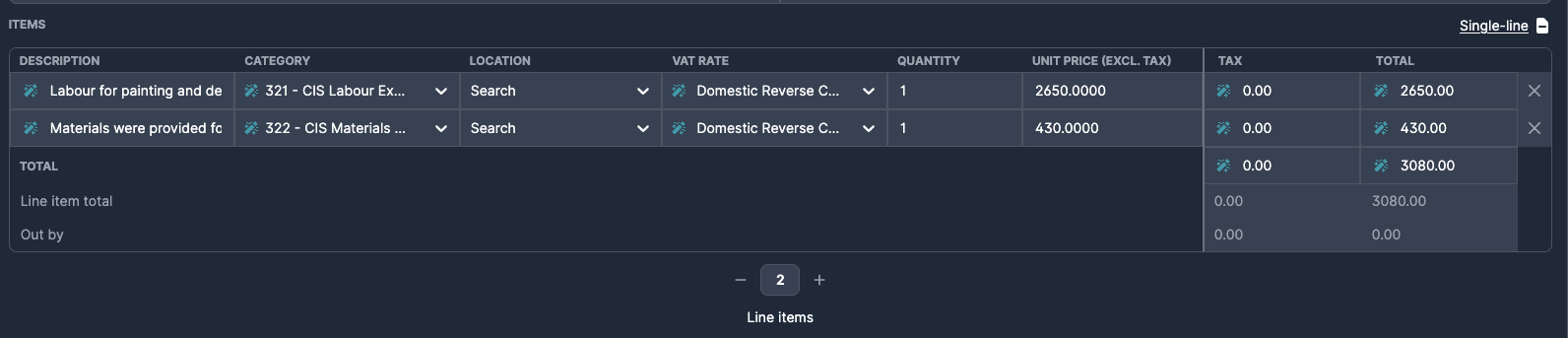

Briefcase now processes Construction Industry Scheme (CIS) invoices automatically. Upload the invoice and we will:

Split labour vs materials lines

Assign the correct VAT rate to each line

Post each line to the right category

Xero

If the client is configured as a CIS contractor in Xero, Briefcase applies CIS treatment automatically.

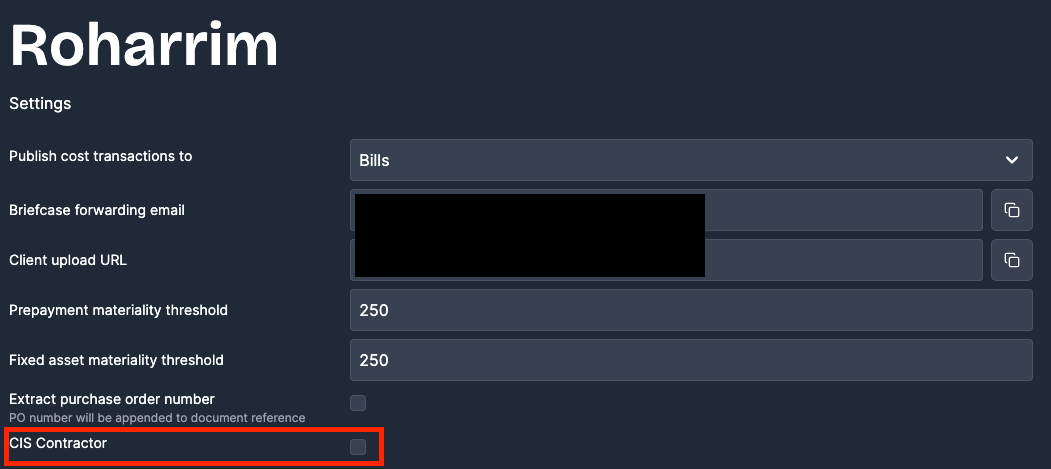

Quickbooks

If CIS contractor status is enabled in Business settings, Briefcase applies CIS treatment.

Because the QuickBooks API doesn’t expose the “Less CIS” field, once you publish invoice you’ll need to enter the CIS deduction there manually.

That’s all for this week. Have any questions, ideas or feedback? Hit reply to this email and let us know.