- Briefcase — Product updates

- Posts

- 💼 Product Update — 8/12/2025

💼 Product Update — 8/12/2025

Full VAT legislation knowledge, Briefcase wrapped, flat rate scheme support

Welcome to our weekly product update. Each week, we highlight Briefcase’s latest features and AI improvements designed to make bookkeeping and accounting workflows simpler and more efficient. Here’s what’s new.

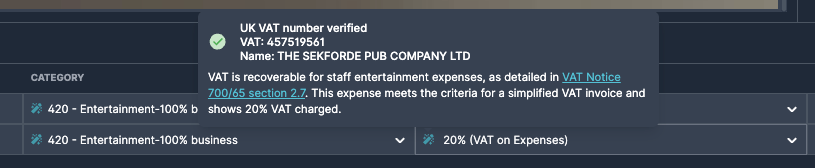

Full VAT legislation knowledge

Briefcase now has an internal database of the of all HMRC VAT Notices.

That means VAT treatments assigned to invoices and receipts will now come with legislation references in the justification field, so you can see exactly how our agents reached a conclusion.

Because these decisions are now grounded directly in legislation, the treatment should be more accurate, consistent and easier to audit.

Briefcase wrapped

We’ve launched Briefcase Wrapped 2025 to summarise your activity over the past year - with personalised stats such as documents processed, VAT numbers verified, prepayments detected and more.

Wrapped is only available to practices (admins and users, not clients) who have at least 50 published cost transactions. It summarises data across all accounts you have access to, and it will be available through to the end of December.

Flat tax rate support

Clients on the Flat Rate Scheme now get the No VAT tax rate applied automatically.

For Xero users: Briefcase syncs the flat rate directly from Xero.

For QuickBooks users: Configure it manually in Business Settings → Tax → Tax Scheme.

That’s all for this week. Have any questions, ideas or feedback? Hit reply to this email and let us know.